THIS IS US

Governance and Team

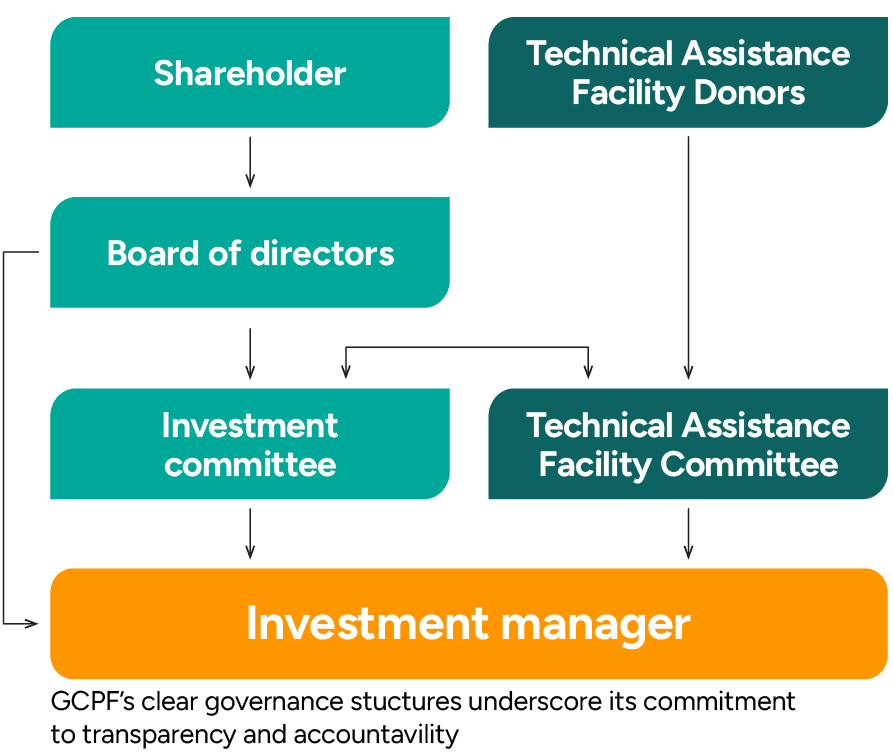

We have clear governance structures in place, underscoring our commitment to transparency and accountability.

Governance bodies drive our strategy and ensure that we do things right, while the Investment Manager’s Team is responsible for making it all happen on the ground.

The Global Climate Partnership Fund is an investment company under Luxembourg law. It was established by the German Federal Ministry for the Environment, Nature Conservation, Building and Nuclear Safety (BMUB) and KfW Entwicklungsbank in 2009.

Board of Directors

Appointed by the GCPF shareholders, the Board of Directors has an oversight role

and is responsible for defining GCPF’s strategic direction.

It has sole power to administer and manage the Fund.

Carolin Gassner

Board Chair

Carolin Gassner is First Vice President and Head of Department South Asia within KfW, where she has worked over 24 years. Within KfW, she has held different senior and management positions in the areas of development finance, asset securitization, and credit risk. Before taking over the current position, Carolin headed the Department Credit Risk Management, Financial Institutions and Country Risk. Ms. Gassner holds a Master Degree in Economics from the Eberhard Karls University in Tübingen, Germany, a Postgraduate Certificate of the German Development Institute, Bonn, and a Senior Executive Programme Certificate from the London Business School.

Véronique Allarousse

Director and Technical Assistance Committee Chair

Véronique Allarousse is a senior lawyer with 25 years’ experience in development finance, mainly with EBRD and AIIB. She has advised on complex and innovative cross-border sustainable infrastructure transactions in developing markets. Véronique is a member of the Bars of Paris and New York. She is also a Fellow of the Chartered Institute of Arbitrators. Véronique holds an LL.B. and various graduate law degrees from the University of Paris and Harvard Law School.

Paula Alayo

Director

Paula Alayo is an experienced investment professional with over 20 years of buy-side experience in emerging markets with a focus on financial institutions and impact investing. Paula has been with the IFC for more than 18 years as a Principal Investment Officer and country manager, and has effectively managed senior level relationships with clients, investors and government officials in Europe throughout the course of her career.

Paula holds a BS in Finance and International Business from Georgetown University and an MBA from Columbia Business School.

Oliver Griffiths

Director

Oliver Griffiths joined GCPF’s Board in 2023. As Group Director, Online Safety at Ofcom, the UK’s communications services regulator, Oliver oversees the UK’s online safety regulatory regime. Prior to this current role, Oliver served as the Chief Executive of the UK Trade Remedies Authority, where he worked to defend the UK’s economic interests against unfair trade practices such as dumping and trade distorting subsidies. Previously Oliver was the UK’s Chief Trade Negotiator with the US and spent several years establishing the UK’s Green Investment Bank, including as a member of GIB’s Investment Committee making commitments of over £2bn to green infrastructure projects.

Paola D’Angelo

Director

Paola D’Angelo joined GCPF’s Board of Directors in 2024. Paola has more than 20 years of experience in the Luxembourg investment funds industry through her work with depositary banks and as a consultant. For the last 10+ years, she has worked as an impact and development finance professional, providing governance best practices and advisory services to development finance institutions and boards of directors of impact funds. Paola is also an experienced independent board member.

Susan Goeransson

Director

Susan Goeransson joined GCPF’s Board in 2025 and is a seasoned leader in sustainable infrastructure investment, with over 30 years of experience. Most recently, she served as Director and Head of Infrastructure, Europe at the European Bank for Reconstruction and Development (EBRD), where she led strategic initiatives across the municipal, environmental and transport sectors. Her tenure at EBRD spanned more than three decades, including roles such as Head of Municipal and Environmental Infrastructure, Portfolio Manager and Senior Investment Officer.

Susan holds a Master’s in Public Policy from Harvard University and a Bachelor’s in both History and Urban Studies from Northwestern University. She is also a Chartered Financial Analyst (CFA), certified by the CFA Institute since 1987.

Based in London, Susan is recognized for her expertise in project finance, sub-sovereign finance and emerging markets.

Investment Committee

The Investment Committee is appointed by the Board of Directors.

Its main function is to approve the investment decisions proposed by the Investment Manager

and to monitor its other investment activities.

Jürgen Welschof

Investment Committee Chair

Jürgen Welschof joined GCPF’s Investment Committee in April 2018. Jürgen has over 22 years of experience in development finance. He started to work at KfW Group in 1995. He has held various positions at KfW with a focus on direct investments in water and waste water management in the Middle East & North Africa region and has been heading KfW’s sector policy division for 6 years. In 2010, Jürgen became KfW’s country director in Serbia and Macedonia, where more than half of KfW’s portfolio consists of energy projects, including direct investments in thermal, hydro, wind and biomass power plants, as well as a large number of credit lines for energy efficiency and renewable energy. He currently heads the Energy South Asia Division of KfW Development Bank, a post he has held since early 2015.

Ritva Laukkanen

Investment Committee Member

Ritva Laukkanen joined GCPF’s Investment Committee in April 2020. She has over 30 years of experience in development finance and international financial markets. She held various technical and executive positions at the IFC, overseeing origination and portfolio management in the Eastern/Southern Europe and Central Asia financial sector, with focus on Micro/SME finance, as well as in other sectors globally including sustainable forestry. Before moving to the investment side, Ritva spent nearly 10 years at the IFC Treasury developing new emerging capital markets. Prior to IFC, Ritva worked 8 years in New York at a Scandinavian consortium bank, American Scandinavian Banking Corporation. Since 2012 she has been acting as a non-executive director in various development finance institutions including Magma Fincorp. Ltd. (an Indian SME lender), Acleda Bank PLC in Cambodia and AccessHolding Microfinance AG, as well as chairing the Board of the Finnish development finance institution – Finnfund.

Marie-Paule Claes

Investment Committee Member

Marie-Paule joined the Investment Committee in 2023 and has more than 25 years of financial-sector experience including two decades in impact finance in emerging markets and developing countries. As an independent consultant, she provides advice to private and public clients in the areas of MSME finance, institutional and market diagnostics, risk management, business, and impact strategies.

Her earlier experience includes work on staff at the International Finance Corporation (IFC) as a principal investment officer in the Financial Institutions Group and pioneering work as a senior investment officer of the Belgian Investment Company for Developing Countries (BIO), where she built a partner network and investment pipeline and created operational tools and procedures. Marie-Paule started her professional career at ABN AMRO Bank, holding multiple positions. She has served and serves on multiple boards of directors and other governance bodies in the impact field.

Marie-Paule holds a master’s degree in commercial business engineering from Katholieke Universiteit Leuven and a master’s degree in management, with honors, from University of Barcelona and Katholieke Universiteit Leuven.

Claudia Huber

Investment Committee Member and Technical Assistance Committee Member

Claudia Huber joined GCPF’s Investment Committee in 2024 and Technical Assistance Committee in 2025. Claudia has worked in the impact finance and financial inclusion sector for more than 20 years and has sat on the Boards and Investment Committees of several impact Funds. Claudia gained her experience managing credit and deposit sides for microfinance and SME banks in Africa and Latin America, as well as working with CGAP/The World Bank, GIZ and the Jacobs Foundation. In 2014, Claudia founded devImpact, a consultancy company offering strategic advice and operational implementation support to financial institutions serving MSMEs as well as to donors and investors aiming at designing and implementing impactful interventions to support economic development and sustainable livelihoods, particularly in rural areas. Claudia has a Master’s in Business Administration and a CEMS Master’s in International Management from the University of St. Gallen (HSG) in Switzerland and is fluent in English, French, Spanish and German. She has long and short-term working experience in Sub-Saharan Africa and Latin America.

Alfred Helm

Investment Committee Member

Alfred Helm joined GCPF’s Investment Committee in 2025. Alfred is an experienced development banker, qualified both as a chartered accountant and development economist, with more than 30 years of experience working in overseas development acquired through working for multilateral development banks and other eminent organisations. Particular areas of specialisation include the financing of private sector transactions, infrastructure investment, the public-private interface, strategies and policies of multilateral development banks, evaluation of development projects and initiatives, public finance and small island development.

Technical Assistance Committee

Appointed by the Board of Directors, the Technical Assistance Committee ensures

that the Technical Assistance provided by GCPF supports the fund’s objectives and activities.

Véronique Allarousse

Director and Technical Assistance Committee Chair

Véronique Allarousse is a senior lawyer with 25 years’ experience in development finance, mainly with EBRD and AIIB. She has advised on complex and innovative cross-border sustainable infrastructure transactions in developing markets. Véronique is a member of the Bars of Paris and New York. She is also a Fellow of the Chartered Institute of Arbitrators. Véronique holds an LL.B. and various graduate law degrees from the University of Paris and Harvard Law School.

Claudia Huber

Investment Committee Member and Technical Assistance Committee Member

Claudia Huber joined GCPF’s Investment Committee in 2024 and Technical Assistance Committee in 2025. Claudia has worked in the impact finance and financial inclusion sector for more than 20 years and has sat on the Boards and Investment Committees of several impact Funds. Claudia gained her experience managing credit and deposit sides for microfinance and SME banks in Africa and Latin America, as well as working with CGAP/The World Bank, GIZ and the Jacobs Foundation. In 2014, Claudia founded devImpact, a consultancy company offering strategic advice and operational implementation support to financial institutions serving MSMEs as well as to donors and investors aiming at designing and implementing impactful interventions to support economic development and sustainable livelihoods, particularly in rural areas. Claudia has a Master’s in Business Administration and a CEMS Master’s in International Management from the University of St. Gallen (HSG) in Switzerland and is fluent in English, French, Spanish and German. She has long and short-term working experience in Sub-Saharan Africa and Latin America.

André Degenkolb

Technical Assistance Committee Member

André Degenkolb joined GCPF’s Technical Assistance Committee in 2025. André currently holds a position as a Senior Consultant at KfW, Germany’s state-owned investment and development bank. Previously he was seconded to the KfW office in Jakarta to coordinate the bank´s energy portfolio. Before joining KfW in 2017, he held the role of Head of Green Finance at IPC, a consultancy specializing in development finance including energy and the environment. André has experience managing interdisciplinary teams of banking experts, engineers and marketing experts in the implementation of green finance project at banks in emerging markets.

Investment Manager’s Team

The Investment Manager, responsAbility Investments AG,

is responsible for running our business activities and for managing the Technical Assistance Facility.

The Team working on GCPF is comprised of more than 25 motivated people. Only a selection of these are shown here.

Ewout van der Molen

Head of Fund

Ewout joined as the Investment Manager’s Head of GCPF in 2023. His prior experience includes more than 20 years at the Dutch development bank FMO, where Ewout worked a as team manager, board member and as chair of FMO’s investment committee. He has extensive experience in structured debt and equity transactions for project finance, corporate clients and financial institutions in Latin America, Africa, Asia and Eastern Europe. His personal objective is to make things work together with clients and add value as a partner and collaborator.

David Diaz Formidoni

Head of Financial Institution Investments

David Diaz has been working for GCPF since 2014. He leads a global team in the sourcing, structuring and execution of investments via local financial institutions for GCPF, and has extensive expertise in designing climate positive lending strategies and tailoring advisory support for financial institutions across Latin America, Eastern Europe and the Caucasus, Sub-Saharan Africa and Asia Pacific.

David was born and raised in Ecuador, and studied Economics and Philosophy at Columbia University and International Affairs at Sciences Po Paris. He is currently taking a post-graduate program through Yale University on the topic of tropical forest conservation, and has a passion for fungi of all kinds.

Stefan Issler

Head of Direct Investments

Stefan Issler has 15+ years of experience in the financial industry with a focus on climate finance over the past years. He has êxtensive knowledge of business practices in developing countries, including 50+ due diligences conducted in 20+ countries and has a strong network in Sub Saharan Africa as he was based for more than four years in Nairobi, Kenya.

Stefan leads a team of investment professionals responsible for debt financing for companies and projects in sectors including energy access, distributed energy for C&I off-takers, small-scale renewable energy generation, electric mobility, and more.

Stefan has a Master’s degree in Economics from the University of Zurich and a Master of Advanced Studies in Development and Cooperation from the Swiss Federal Institute of Technology Zurich.

Sathish Dhanapal

Head of Climate Advisory Specialist Team

Sathish Dhanapal is the Head of the Climate Advisory Specialist Team for GCPF and has 15+ years of experience in advising various corporates and governments in implementing climate mitigation technologies. He leads a global team of climate advisory specialists that support partners in implementing climate mitigation strategies. Sathish holds a bachelors degree in Energy & Environmental Engineering from Tamil Nadu Agricultural University, India.

Eva Tschannen

Head of Technical Assistance

Eva Tschannen has led the Technical Assistance team for GCPF since 2014. Previous to her current role, Eva worked for over 10 years in the private sector in roles relating to developing countries, including more than five years in development investments.

She is passionate about creating client-centric projects to scale sustainable impact of GCPF’s investments and beyond.

Eva has a Masters degrees in international affairs and governance from the University of St.Gallen and Sciences Po (Paris).

Heather Kirk

Head of Operations

Heather has been working with GCPF since 2022, and manages operational processes, governance topics and special projects in relation to the fund.

She is a former professional scientist, and also has an entrepreneurial spirit – after her scientific career she founded a social enterprise focused on integrating people from a refugee background in Switzerland. She subsequently transitioned to sustainable finance, a field that has inspired her because of its potential for impact at scale.

Mahendra Gunasekera

Head of ESG Analysis

Mahendra has been the ESG lead for GCPF since 2021. He is an environmental engineer with over 20 years’ experience in the energy sector and more than 10 years’ specifically in environmental and social due diligence and performance monitoring in lender, borrower and consultant settings. He has worked on projects located in over 30 countries.

Rita Sharma

Product Manager

Rita has been with GCPF since 2022 and is the first point of contact for GCPF investors and service providers. She manages processes and projects related to the Fund’s operations and governance, including for example the Fund’s annual audit process and management of investor agreements.

Prior to joining the Fund she worked in depositary services at Danske Bank in Denmark and Norway for seven years. Rita has a Master of Science and Business Administration from Copenhagen Business School.